will capital gains tax rate increase in 2021

We Are High Volume Shipping Experts. This means that high-income single investors making over 523600 in tax year 2021 have to pay the top income tax.

What Are Capital Gains Tax Rates In Uk Taxscouts

Capital gains tax is likely to rise to near 28 rather than 396 as Joe Biden plans Goldman said.

. Capital gains tax increase 2022 aetna dental ppo fee schedule 2022 pdf capital gains tax increase 2022 barstool sports sling promo capital gains tax increase 2022. Capital Gains Tax Rate Update for 2021. The effective date for this increase would be September 13 2021.

7 rows Hawaiis capital gains tax rate is 725. Democrats are discussing whether to make a proposed increase in the individual capital gains rate effective on the date the proposal is introduced. If you have a long-term capital gain meaning you held the asset for more than a year youll.

President Joe Biden proposed a top federal tax rate of 396 on long-term capital gains and qualified dividends. The Wall Street Journal reports that President Bidens proposed capital-gains tax rate increase is assumed to have taken effect Apr. Capital gains tax could double in 2021 or 2022.

Common Surcharges Rate Increases 10 Year UPS Pricing Trends More. As proposed the rate hike is already in effect for sales after April 28 2021. Ad Wealth Enhancement Group Provides Comprehensive Financial Guidance Nationwide.

The Golden State also has a sales tax of 725. That applies to both long- and short-term. CAPITAL GAINS TAX will increase in the next couple of years to a 28 percent rate according to Nimesh Shah of Blick Rothenberg.

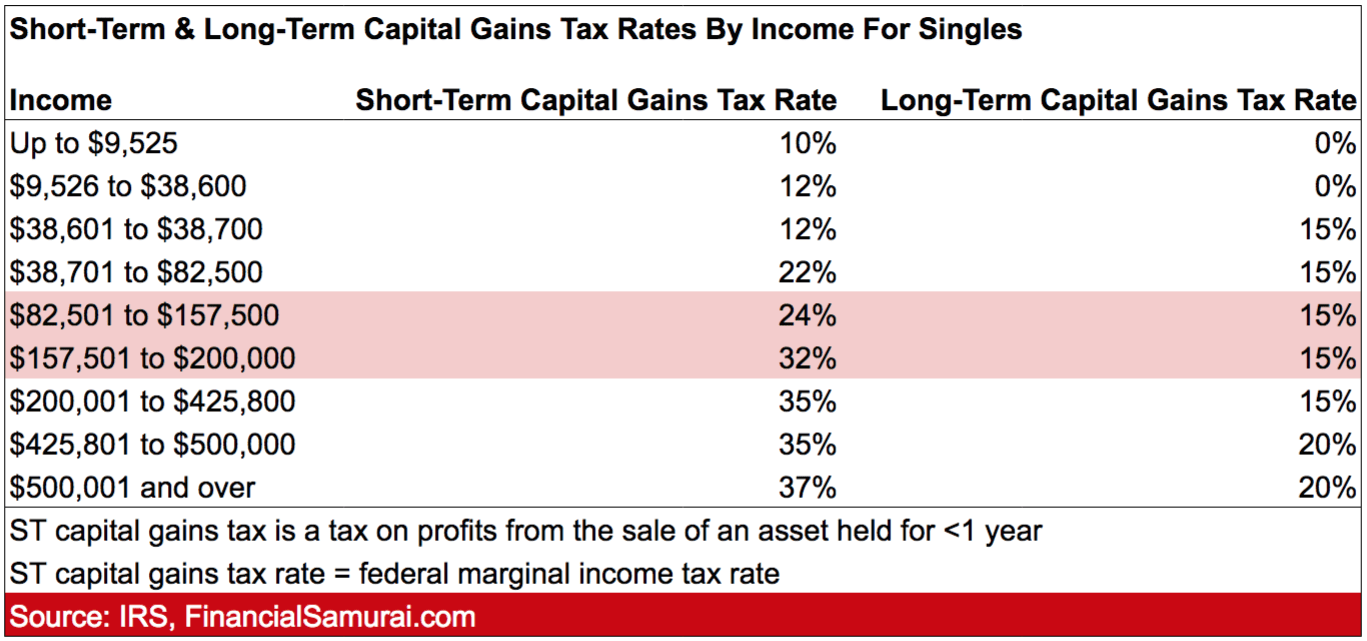

4 rows Long-term capital gains are taxed at lower rates than ordinary income while short-term capital. On April 28 2021 President Biden released the American Families Plan which included a proposal to increase the long-term capital gains tax rate for households with. The bank said razor-thin majorities in the House and Senate would make a big.

In some other places these gains may be. The top 01 a group of just 120000 people earning an average of more than 11 million a year earned more than half of all capital gains income in the United States in 2019. Short-term gains are taxed as ordinary income.

A Guide to Understand Your Options With RSUs Deferred Comp Plans More. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. We Are High Volume Shipping Experts.

The Biden administration has proposed an increase in the current favorable capital gain rates for people earning more. Its been paying dividends for more than 140 years and increased the payment for 25 consecutive years. With average state taxes and a 38 federal surtax the.

While it is unknown what the final legislation may contain the elimination of a rate. A Guide to Understand Your Options With RSUs Deferred Comp Plans More. Add state taxes and you may be well over 50.

Ad Wealth Enhancement Group Provides Comprehensive Financial Guidance Nationwide. 2021-2022 Short-Term Capital Gains Tax Rates. Therefore there could be an additional 8 tax on a transaction that closes in 2022 vs 2021.

35 Trillion Spending Package Update Under the Biden-Democrat social infrastructure plan long term Capital gains tax rates could increase to 25 from 20 for. There is a progressive income tax with rates ranging from 1 to 133 which are the same tax rates that apply to capital gains. The 238 rate may go to 434 an 82 increase.

Common Surcharges Rate Increases 10 Year UPS Pricing Trends More. Currently the top federal tax rate is 238 and could jump to 434 under the latest tax proposal. By Charlie Bradley 0700 Thu Oct 28 2021 UPDATED.

How To Forecast Shipping Costs From The New Rates. How To Forecast Shipping Costs From The New Rates. The proposal would increase the maximum stated capital gain rate from 20 to 25.

Based on filing status and taxable income long-term capital gains for tax year 2021 will be taxed at 0 15 and 20. Get someone to do. As of September 7 2021 the share price is 3397 a year-to-date gain.

At the end of this post I share a. This is also true for some states as there may be a system of tax brackets where the rate is higher as the money earned increases. Short-term capital gains are taxed as ordinary income meaning the rates are the same as for the income you earn from your job.

The IRS taxes short-term capital gains like ordinary income. Capital gains tax rates on most assets held for a year or less.

Spain Cryptocurrency Tax Guide 2022 Koinly

Capital Gains Tax What It Is How It Works Seeking Alpha

2022 And 2021 Capital Gains Tax Rates Smartasset

2022 And 2021 Capital Gains Tax Rates Smartasset

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Difference Between Income Tax And Capital Gains Tax Difference Between

A Programmer Tries To Figure Out How Capital Gains Tax Actually Works By Fpgaminer Hackernoon Com Medium

Capital Gains Taxation And Deferral Revenue Potential Of Reform Penn Wharton Budget Model

Capital Gains Tax What Is It When Do You Pay It

How To Pay 0 Capital Gains Taxes With A Six Figure Income

The Average Household Income In America Financial Samurai

2022 Capital Gains Tax Rates By State Smartasset

2022 And 2021 Capital Gains Tax Rates Smartasset

Capital Gains Tax Advice News Features Tips Kiplinger

Joe Biden Tax Plans Proposals Tax Foundation

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2022 Capital Gains Tax Rates By State Smartasset